The best source of valuable information regarding Canadian Tax Shelters – rigorously put together by a team of volunteers who know the perils of gift-giving tax shelters all too well.

End Tax Shelters Support

How to Deal with the Canada Revenue Agency

Helpful "How-To" CRA Videos

How To Sign Up with the CRA Online

Manage ALL your tax information online by signing up for the Canada Revenue Agency’s online portal, ‘My Account.’ Watch this video to learn more about ‘My Account’ and how to sign up.

This is very helpful if you need to know what you owe and get the information you need without calling the tax professionals.

How to Speak with CRA Agents

Have you been contacted by the Canada Revenue Agency? It’s always best to provide honest and up-front information with CRA agents, as this video explains.

A helpful video explainer on how to talk to CRA agents and how to get the information you need.

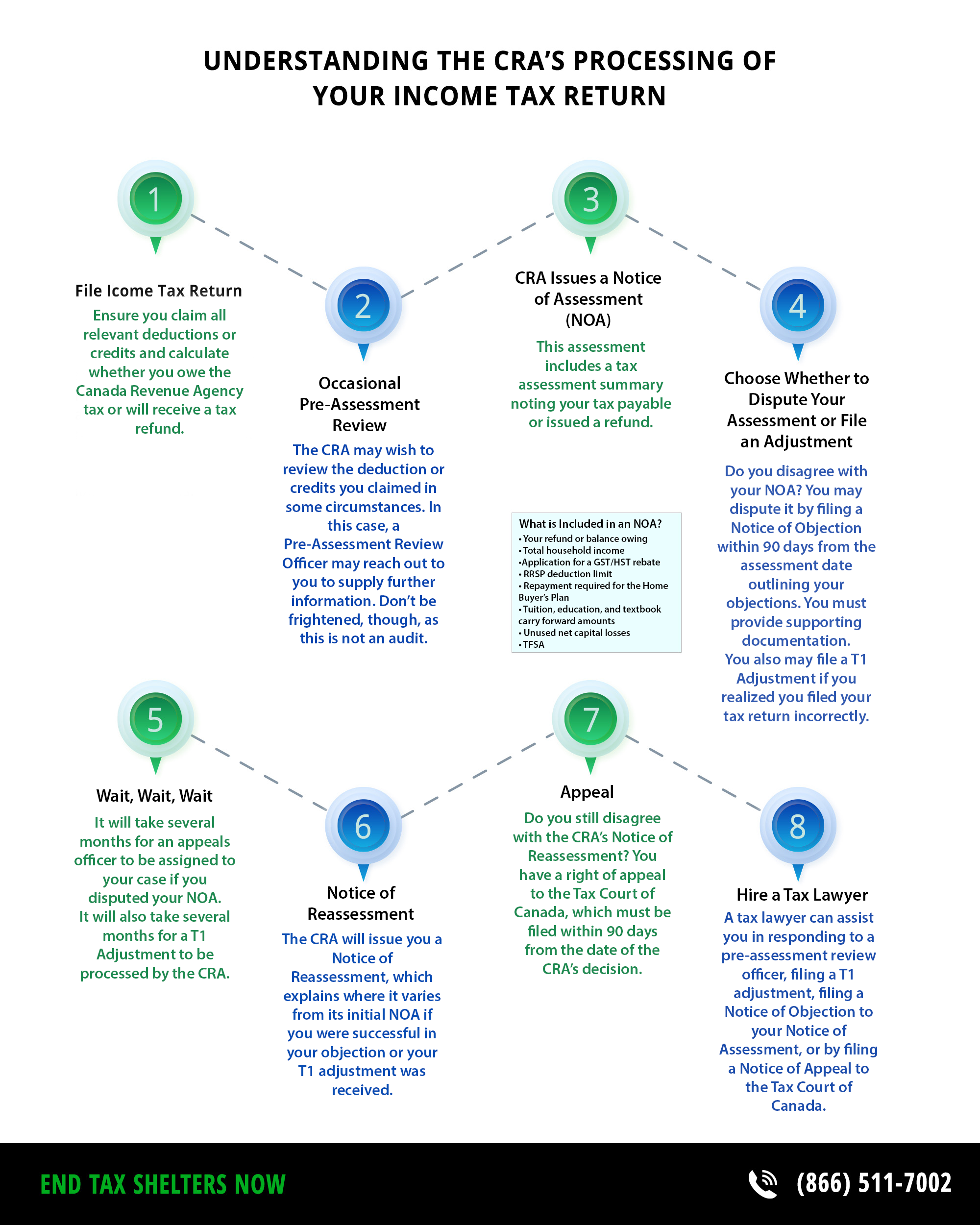

How to Appeal CRA Decisions

Do you not agree with a CRA decision? This helpful video explains exactly how to appeal CRA decisions; including all the steps you must take.

How to File a Formal Dispute or Objection with the CRA

Do you disagree with a CRA tax assessment or reassessment? This video explains what you need to do in order to file an objection or formal dispute to the CRA.

CRA References

- Tax Shelters - Know The Risk. Information provided by the CRA.

- Have you received a suspicious call from someone claiming to be the CRA? Click this link to learn how to avoid being scammed.

- Instructions on how to apply for a tax shelter identification number. It's unreal that this exists. Please, DO NOT DO THIS TO ANYONE.

Helpful Public Articles & Blogs

- How to Contact the CRA Without Losing Your Mind

- CTV - CRA Wrong on 1 in 4 business tax answers: survey

- CBC - Canadians calling CRA facing longer wait times, getting unreliable answers, CFIB audit finds

- Toronto Star - CRA call agents were given wrong info on CERB eligibility, union head says

- The Decline of the Successful Tax Shelter

A Brief History of Canada's Tax Shelters

Read the articles below to learn how the CRA’s opinion on Canadian tax shelters transformed over the years.

- Investment Executive - CRA's actions alarm tax-shelter promoters and investors (2005)

- Financial Post - Beware these tax shelters: You will be audited and your claim will probably be rejected (2014)

- The Globe and Mail - How the wealthy reduce the tax-man’s take (2017)

- Investment Executive - “Hallmark” regime proposed to crack down on aggressive tax planning (2010)

Editorial Disclaimer

IMPORTANT NOTICE AND DISCLAIMER This website is owned and hosted by a private corporation. Articles appearing on this website should be considered informational and educational only. Our company and volunteers and The Publisher has not been compensated by any of the profiled companies.

The Publisher has not participated in the creation of the content of any articles appearing on this website and so cannot guarantee the accuracy or completeness of the information in any of the articles. The Publisher expressly disclaims any responsibility or liability for statements made in any of the articles.

NO TAX OR FINANCIAL ADVICE OFFERED. The articles on this website are not, and should not be construed to be, offers to sell or solicitations of an offer to give any tax or financial advice. Neither the articles on this website nor the Publisher purports to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a tax expert or financial expert. The articles on this website are not, and should not be construed to be, personalized tax advice directed to or appropriate for any particular person. Any decision should be made only after consulting a professional tax shelter advisor and only after reviewing the client’s full situation. Further, readers are advised to read and carefully consider the Risk Factors identified.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading articles on this website, you acknowledge that you have read and understood this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from articles appearing on this website. You further warrant that you are solely responsible for any advice outcome that may come from your investment decisions.

LINKS TO THIRD PARTY WEBSITES. This website enables users to link to external websites not under the control of The Publisher. The Publisher has no control over the nature, content, and availability of those sites. The inclusion of any links is not intended as, and should not be construed as, a recommendation or endorsement of the content or views expressed on such external websites. The Publisher expressly disclaims any representation concerning the quality, safety, suitability, or reliability of any external websites and the content and materials contained in them. It is important for users to take necessary precautions, especially to ensure appropriate safety.